A large part of wealth is tied up in property. And as home prices go up, this is a hidden but significant part of a person’s wealth. When managed well, it becomes a great tool to propel that wealth forward.

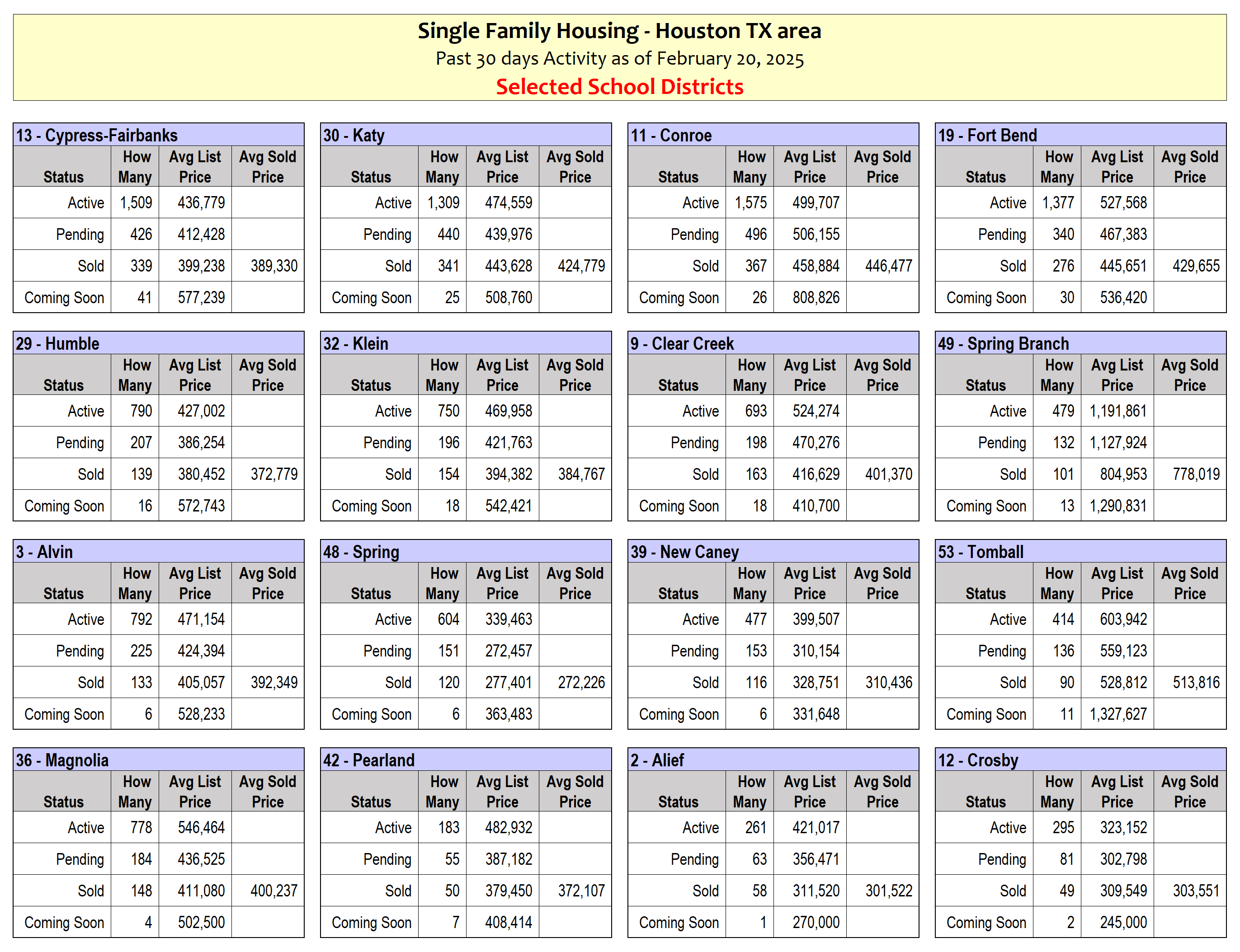

Keep your finger on the pulse of your hyper local market to understand why home prices go up. New stores (and store closings), changes to school zoning, and home sales on your street materially affect your home’s value. Connect with a trusted resource and stay informed.

Over the past few years, you’ve probably seen a whole lot of headlines about how home prices keep going up. But have you ever stopped to think about what that actually means for your home?

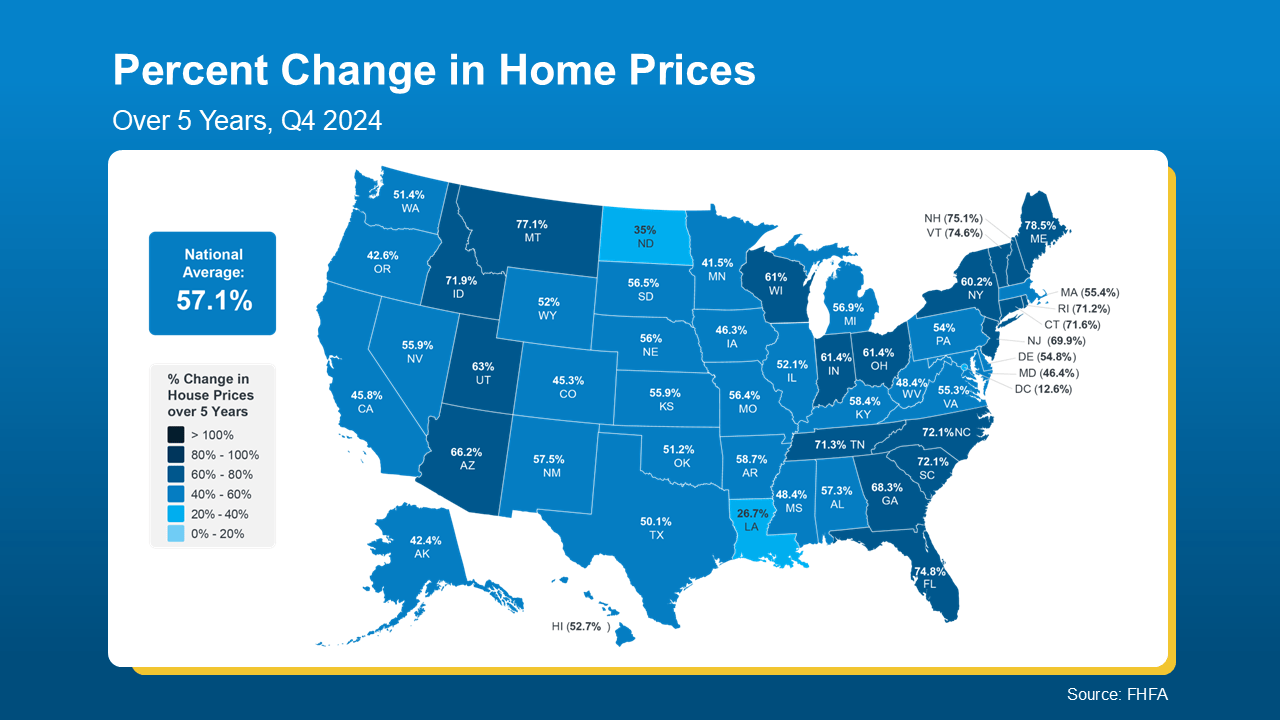

Home prices have risen dramatically over the past five years — far more than usual. And if selling has been on your mind, this could mean a bigger-than-expected payday when you list. So, how much has your home’s value really changed? Let’s break it down.

How much home prices go up – The Rapid Rise of the Past 5 Years

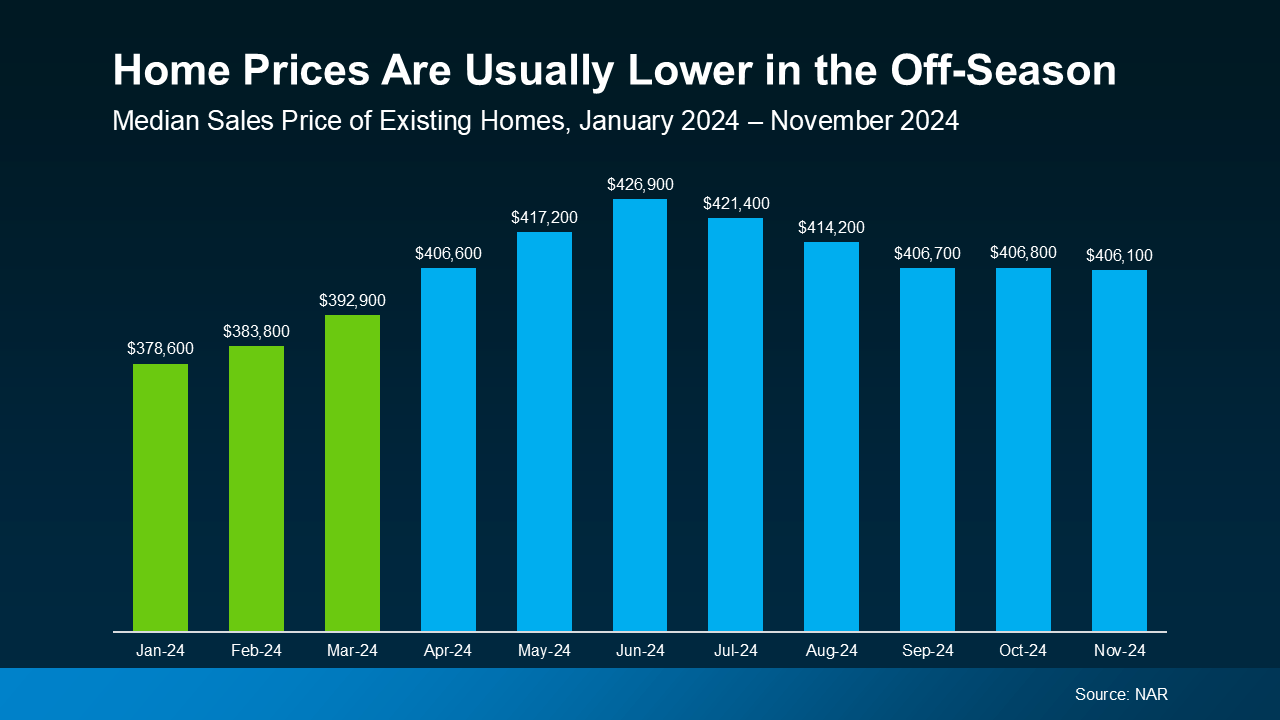

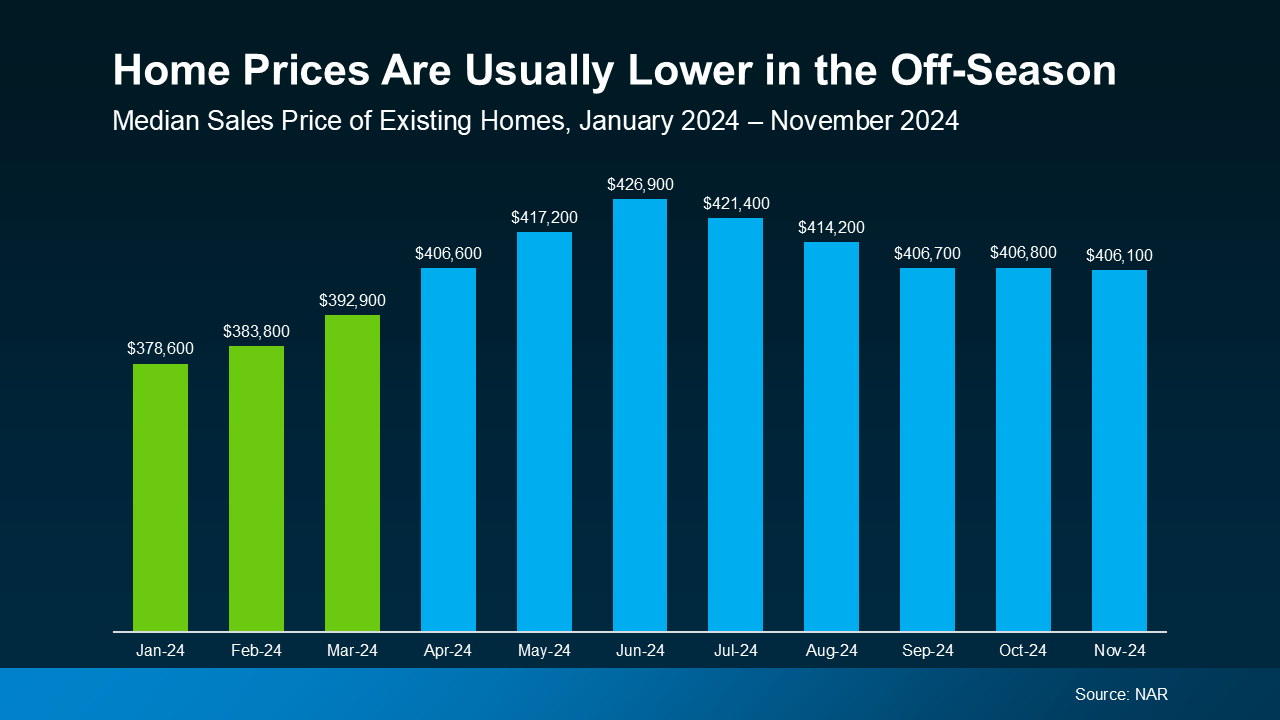

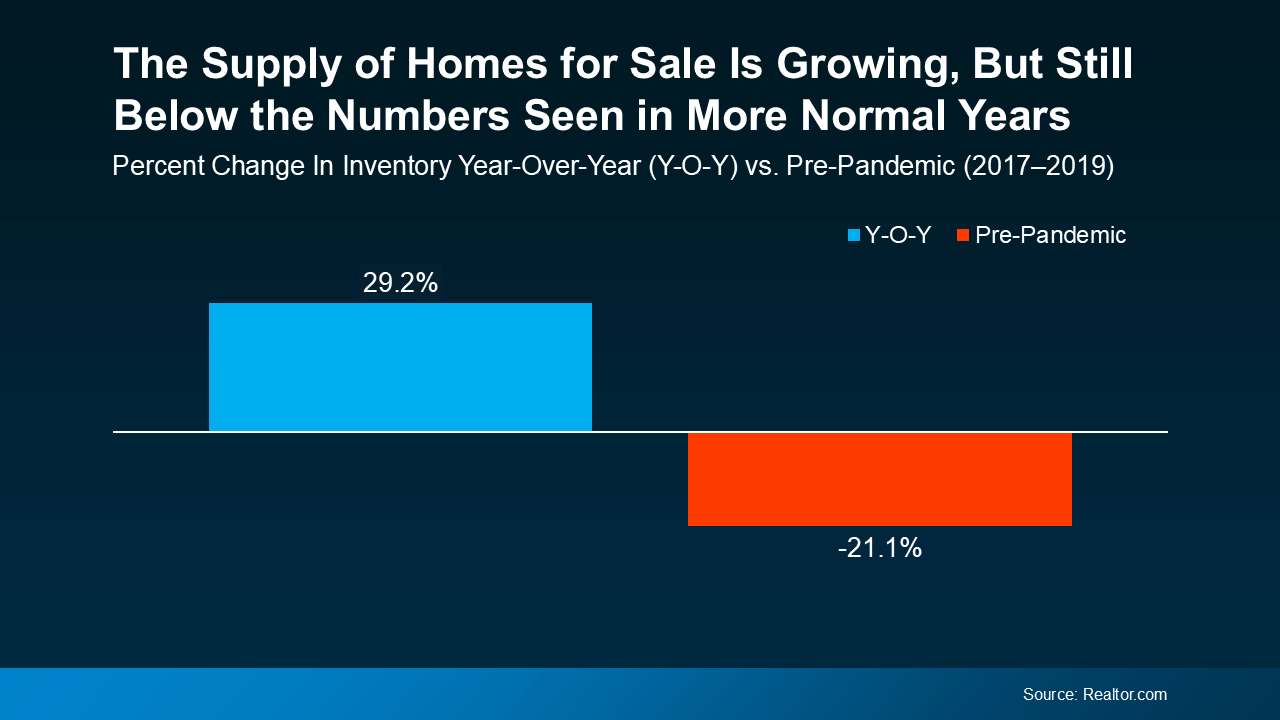

Typically, home prices go up by about 2-5% a year. But in 2021-2022, there were double-digit increases. And at the peak, prices rose by a staggering 20% or more nationally. Why? There were way more buyers than homes available, which sent prices soaring. While things have normalized since then, you still get to reap the benefits of those massive increases.

Your house has gained way more value than it normally would in such a short period of time – and that means a lot more wealth for you, too.

The map below uses data from the Federal Housing Finance Agency (FHFA) to show that, nationally, prices have gone up by nearly 60% in just the past 5 years alone. Here’s a breakdown that takes that one step further and gives you the numbers by state:

If you’ve been holding off on selling because you were worried about buying your next home at today’s rates and prices, let that sink in. It may be more than enough to help close the affordability gap and get you into your next house.

If you’ve been holding off on selling because you were worried about buying your next home at today’s rates and prices, let that sink in. It may be more than enough to help close the affordability gap and get you into your next house.

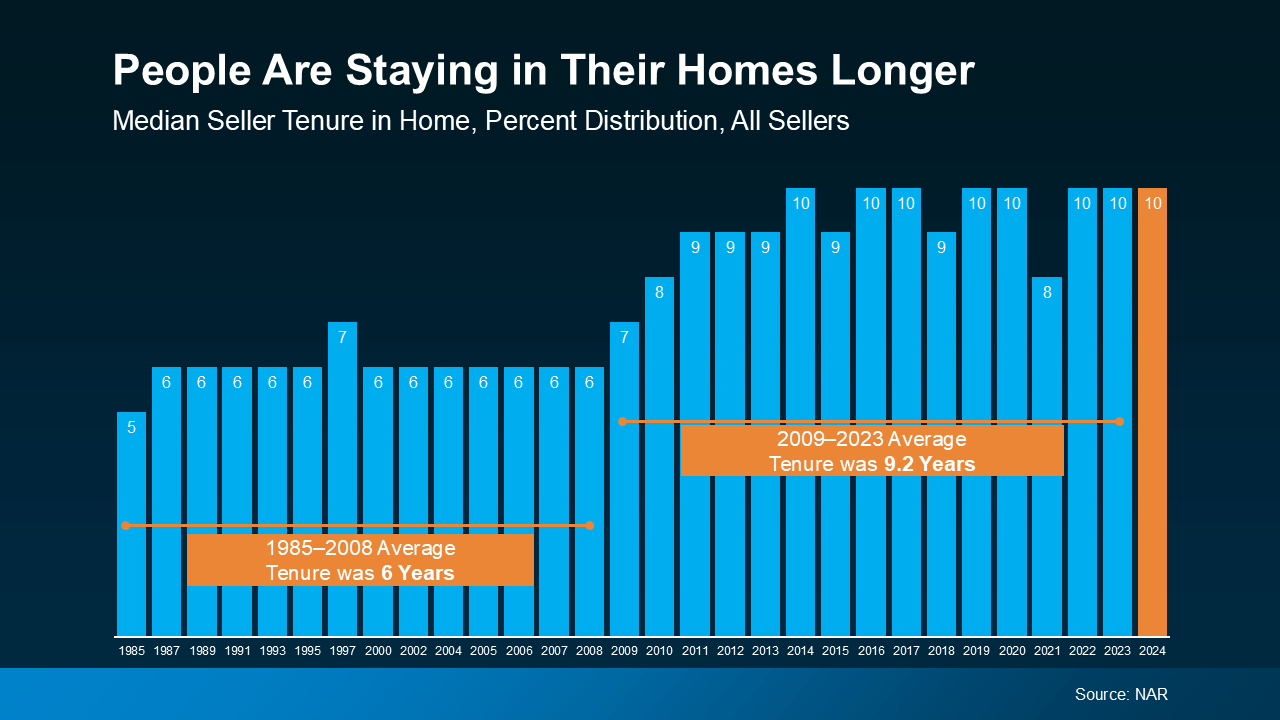

And what if you’ve been there for longer? That means your home’s value is probably even higher now. You get to stack the abnormal gains of the past 5 years on top of five years of more normal appreciation too. And an agent can help you figure out what that really looks like.

Check out this article talking about the importance of a long term view as opposed to buying a property at the “right” time.

How To Find Out What Your House Is Really Worth

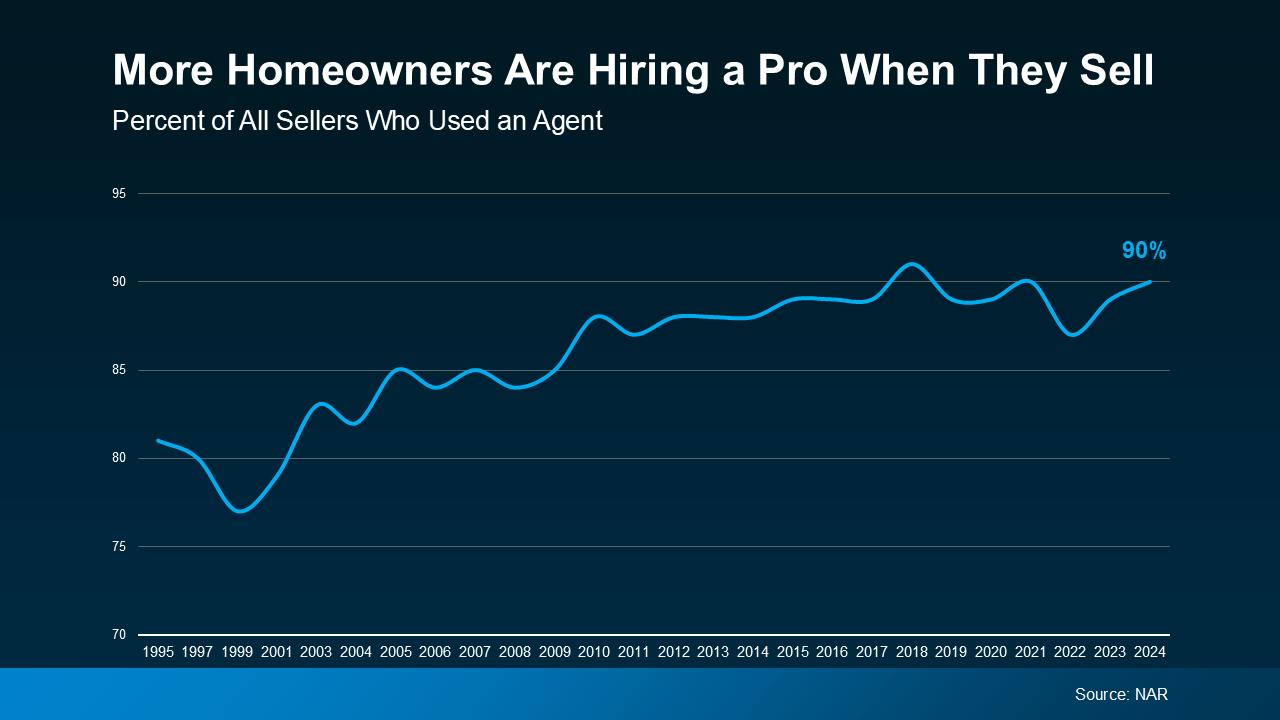

While a percentage is great, you probably want more specific numbers. The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

While the map above gives you the average appreciation rate by state, it doesn’t take your local market into consideration. Like, is inventory still low where you live? That may drive prices higher, and faster. Or maybe you’ve done renovation that’ll add even more value to your house. Those are insights you’ll need an agent to provide.

An agent will know what’s happening where you live and can stack that up against the data and the condition of your home to give you the best estimate of its value possible. Only they have the data and expertise to find out your real number today.

Bottom Line

Home values have climbed — maybe more than you expected. Contact me to learn more.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link